A different approach to a difficult transition.

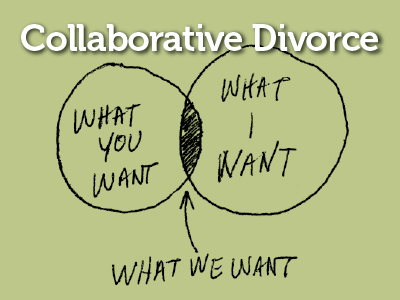

It may seem a bit ironic to use the words “collaborate” and “divorce” together, but it is an alternative approach to dissolving a marriage that’s worth a close look if you are facing this major life transition.

What is Collaborative Divorce?

Collaborative divorce is a legal approach to ending a marriage that seeks to avoid litigation while resolving conflicts through negotiations. Attorneys, mediators and other professionals such as financial planners may still be involved in the process, but everyone agrees to try to cooperate and negotiate (vs. litigate) a settlement. If no agreement or settlement is reached, then parties are free to pursue the traditional divorce approach through litigation.

According to collaborativedivorce.net, a collaborative divorce includes:

- A “Participation Agreement” which establishes some basic ground rules;

- Attorneys communicating and assisting both parties in non-adversarial negotiations;

- Greater emotional protection for the children from the marriage;

- Independent, neutral experts;

- An agreement that there will be no changes to child rearing, assets, insurance plans or other matters during the process without mutual consent; and

- Attorneys, mediators and other involved professionals committed to managing the conflict, emotional and relationship issues creatively and sensitively.

How does it differ from “typical” divorces?

The biggest and most obvious difference between a collaborative and traditional divorce is the involvement of the court. Collaborative divorce excludes court involvement entirely. Another major difference is the full disclosure and agreement by and between the spouses that there will be no adversarial, nefarious or vindictive maneuvers during the negotiations.

This honest approach often results in less emotional trauma to any children and more peaceful resolutions and compromises for both spouses, since fairness is an over-riding concern throughout the process. Professionals that are typically involved in divorces, such as lawyers, mediators, and financial consultants, receive special training in how to approach a collaborative divorce.

Advantages

There are many possible advantages to collaborative divorce, including:

- It can be faster and less expensive than an extended litigation; saving time and money.

- Parties often feel that they have been “heard,” since each spouse’s needs guide the negotiations and agreement. It is not a judge who decides, but the affected parties.

- The emotional toll, uncertainty, and anxiety levels are reduced for the entire family, since transparency and fairness are considered paramount and critical to the process.

How can financial planners help the process?

Financial planners involved in collaborative divorces receive special training and designation called Certified Divorce Financial Analyst® or CDFA®. Their role and responsibilities in a collaborative divorce include maintaining impartiality and completion of a thorough review of the family’s finances. The planner reviews and itemizes assets such as homes and cars; debts and loans including mortgage(s); insurance policies and coverage like health and life insurance; as well as the children’s and spouses’ financial needs going forward.

The planner is not operating from a position of trying to “get the most” from one party for another during the collaborative divorce. His or her duty is to maximize the financial strength of the entire family, despite the impending separation and split of the spouses, for the long-term benefit of all.

Sources and Resources:

http://www.collaborativedivorce.net

https://www.justia.com/family/divorce/the-divorce-process/collaborative-divorce/

Christina Ubl, CFP® CDFA ™ is co-owner of Clute Wealth Management in South Burlington, VT and Plattsburgh, NY, an independent firm and registered investment advisor that provides strategic financial and investment planning for individuals and small businesses in the Champlain Valley region of New York and Vermont. Clute Wealth Management and LPL are separate entities. The opinions voiced in this material are for general information only and not intended to provide specific advice or recommendations.

Securities and advisory services offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.