3 min read

Why Having Disability Insurance Actually Protects Your Most Valuable Assets

Adam Robert : April 24, 2024

Wouldn’t you love to have a very accurate, high-definition crystal ball? One that gives you a clear view of what might come in the days, months, and years ahead? Of course there’s little use in wishing to see the future. All we can do is work with the facts and statistics of what we know today, to help prepare for tomorrow.

The same can be said for disability insurance. The statistics seem to tell a different story than some common “myths.” None of us fully expect or prepare for the “unexpected.” But things like the pandemic have been a prime example that life hands out surprises to most of us, and of course we don’t see them coming without that crystal ball. Consider this information from the Council for Disability Awareness:

- Just over 1 in 4 of today's 20-year-olds will become disabled before they retire.

- Freak accidents are not usually the culprit. Back injuries, cancer, heart disease and other illnesses cause the majority of long-term absences.

- 64% of wage earners believe they have a 2% or less chance of being disabled for three months or more during their working career. The actual odds for a worker entering the workforce today are about 30%. (CDA Disability Divide proprietary research March 2010 http://www.disabilitycanhappen.org/research/consumer/)

- The average long-term disability claim is for 31.2 months (over 2 and a half year).

Perception of Risk vs. Reality

Think it can’t happen to you? It just might, according to the Council for Disability Income Awareness:

|

A typical female, age 35, 5’4", 125 pounds, non-smoker, who works mostly an office job, with some outdoor physical responsibilities, and who leads a healthy lifestyle has a 24% chance of becoming disabled for 3 months or longer during her working career; |

|

A typical male, age 35, 5’10", 170 pounds, non-smoker, who works an office job, with some outdoor physical responsibilities, and who leads a healthy lifestyle has a 21% chance of becoming disabled for 3 months or longer during his working career. |

You can calculate your risk at: http://www.disabilitycanhappen.org/chances_disability/pdq.asp

How long can you go without your paycheck?

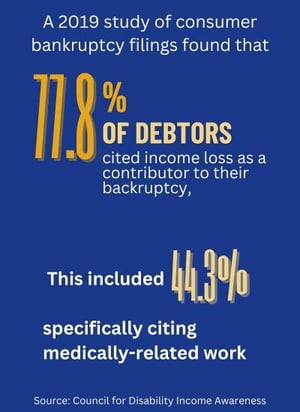

- A 2019 study of consumer bankruptcy filings found that 77.8% of debtors cited income loss as a contributor to their bankruptcy. This included 44.3% specifically citing medically-related work loss as a contributor.

How long can you last without a paycheck?

Of these four points, the last one is perhaps the most important to consider while thinking about disability insurance: How long can you last without a paycheck?

The recent COVID-19 pandemic emphasized the fact that many Americans struggle to keep their emergency savings accounts sufficiently funded with six months of income stowed away, never mind over two years’ worth. That’s why disability insurance is an important financial tool to evaluate. It can help protect your savings and other assets during a time where you may feel the most vulnerable.

There are two types of disability insurance.

- Short-term policies can cover part of your lost income for a relatively brief period of time, from three months up to two years, generally.

- Long-term policies usually insure you until age 65. Generally, policies can pay up to 60% of your salary.

Occasionally disability insurance is offered through your employer; either on a group or individual basis (although in today’s economy many are trimming back on this benefit). However, most people have to obtain individual insurance through a financial advisor and/or insurance professional. Keep in mind that if your employer pays the insurance premium for your disability policy, benefits paid to you are taxable. This is not typically the case if you have an individual policy. People may consider dropping disability insurance when they need to make budget cuts (individually), but they don’t realize the huge benefits they’re dropping by doing so.

A major benefit of an individual disability insurance policy is that it’s portable; you take it with you. This flexibility is critical if you’re changing careers.

Finding the Best Policy for You

The definition of disability can differ between policies. Some policies are considered “own occupation” – for example, if you are a surgeon and a disability leaves you unable to perform surgeries, then you may be eligible to receive full disability benefits even if you have a different job. Other policies are “any occupation” - they cover you only if you are unable to do any type of work at all.

Be sure to determine if the disability insurance policy you are considering has any exclusions for pre-existing conditions. Insurers may exclude a condition altogether or for a period of time, depending on the nature and severity of the condition.

Most people insure their cars and homes, but neglect to protect their most valuable asset, earnings potential. Your financial advisor and/or insurance professional can help you determine if you are eligible for disability insurance and help you evaluate options.

Additional Resource:

http://www.smartmoney.com/plan/insurance/do-you-need-disability-insurance-17318/

Adam Robert, CFP® is a co-owner of Clute Wealth Management in South Burlington, VT and Plattsburgh, NY, an independent firm that provides strategic financial and investment planning for individuals and small businesses in the Champlain Valley region of New York and Vermont. For informational purposes only. LPL Financial does not offer legal or tax advice. Securities and advisory services offered through LPL Financial, Member FINRA/SIPC.

#685940-1 1/23/25