4 min read

How to Balance Your Off-Kilter Business and Personal Finances Today

Heidi Clute : April 9, 2020

Just about anyone can start a business.

Get an idea. Fill out some forms. Register with the necessary local and state agencies. Tell the world about your fantastic new service or product.

But following your dreams is never easy — it’s hard work, fear of failure, loneliness, and mistakes. Running a successful business over time takes a lot more than starting up. And running a successful business without undermining your personal life and finances is an entirely different story.

Small Business Success by the Numbers

You likely know the first five years in business are the most challenging, with a 50 percent failure rate, according to the Bureau of Labor Statistics. Over the long term, roughly 9% of companies both new and old close each year, but 30% of businesses will survive their 10th year in business. How can you make your business success more likely?

Why Businesses Fail

Why Businesses Fail

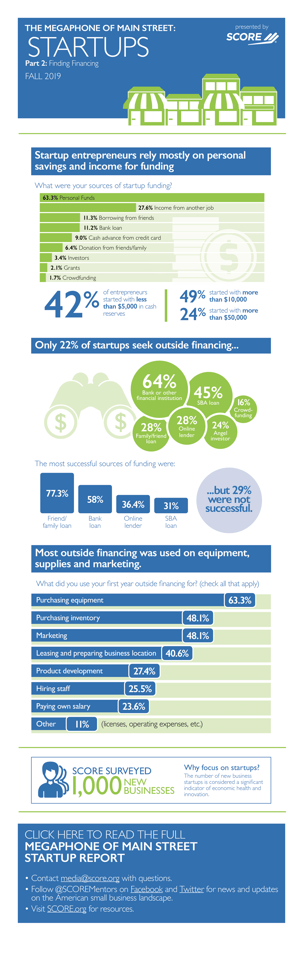

There are countless reasons why a business might fail. According to research, however, there are a few reasons more common than others. One often-overlooked factor is a lack of capital —most Americans start their businesses on their own. An estimated 78% of small businesses rely on personal savings for their initial funds.

Ongoing Interconnection of Business-Personal Finances

Beyond personal savings at startup, the top sources of capital expansion for small businesses are profits/assets, credit cards, bank loans, home equity, and other personal savings. Encore entrepreneurs have several options for financing their businesses, yet the Ewing Marion Kauffman Foundation reports entrepreneurs and researchers often cite lack of access to capital as a significant barrier faced by many entrepreneurs.

A study by US Bank has shown that 82% of small businesses fail due to problems with cash flow. Even if you have followed the best practices around separating your finances from your startup days, your business and personal finances are intertwined and likely off-kilter.

Tips for Balancing Your Off-Kilter Business and Personal Finances

Like many small business owners, you can come to feel if you focus on your business, many other issues – both personal and professional – will work themselves out.

This blurring of the lines between your personal and business lives frequently extends to your thinking about financial planning, too. As well it should, since your most valuable asset will often be your ownership stake in the company.

As an entrepreneur, you need to know, though, that putting your business first and trusting other matters will fall into place can also leave you underprepared or exposed to unnecessary risks when it comes to personal finance questions.

Here are some tips that entrepreneurs want to bear in mind when it comes to positioning yourself to translate your professional success into financial security for yourself, your family, and your heirs.

Risk Management: Establish Multiple Layers of Protection.

As your business grows and evolves, the question of how to separate and adequately protect both the assets of the company and your personal assets can come up repeatedly. Incorporating provides only one layer of protection, and the boundary between business and personal assets can become blurred as you re-invest in your company or experience unexpected legal liability.

Spotting various risks early and insuring against them can provide you with an additional layer of protection and prevent having to put personal assets at risk in the event of an unforeseen lawsuit or accident.

On the personal side, you may sleep better at night by working with legal counsel to determine how to title various assets, identify which assets are attachable for various purposes and which are easiest to protect, and answer other vital questions.

Retirement Planning: Diversification Matters.

For many successful entrepreneurs, your best use of capital is often to re-invest in your business. The know-how, talent, and commitment that helped you establish and build the company will frequently mean that re-committing cash to the business – in essence, betting on yourself – may yield a higher rate of return than might be available through traditional investment options.

But there will always be factors outside your control as a business owner that can impact your company’s valuation and your potential exit strategies. During the financial crisis of 2007-2008, many successful long-time entrepreneurs encountered difficulties with their companies at the same time that they experienced unexpected family crises. Coronavirus (COVID-19) has created a comparable situation. When you need to shift gears and focus on personal matters quickly, will the economic climate make a successful exit from the business highly unlikely?

If you have been careful to diversify your assets by establishing and maximizing a defined benefit plan, when a crisis hits, you can have built up a cushion large enough to allow you to retire from your company and focus on personal matters. Working with a financial advisor to develop a portfolio of assets outside your business means you can have strong options – and the ability to control your own future – when a downturn comes.

Estate Planning: Business and Personal Planning Need to be Aligned.

Most entrepreneurs are acutely aware of the need to establish business continuity and succession plans – in effect, an estate plan for the business – but you may find it challenging to make the time to develop these plans while managing day-to-day operations. Personal estate planning conversations are an opportunity for entrepreneurs to focus on business continuity and succession plans, since these topics are often closely interwoven.

When there will be a change in control for the company after you as the founder retires, you should be clear on how your own family’s desires will impact long-term plans for the company.

Get out of the office.

Almost everything we do today can be done online, so it's tempting to hide out behind your computer screen. But don't forget to get out of the office from time to time. Engaging in personal, face-to-face communication, attending events, and networking are all critical parts of business success — and a successful, balanced personal life.

Summary

For successful entrepreneurs, juggling personal financial needs with those of your business is not a matter of separating the two. Instead, it comes down to understanding how one side of the equation affects the other, and how to plan to balance both. By taking care to establish the right plans and protections for both halves of your overall financial picture as a business owner, you can see to it that you and all of your constituencies – family members, employees, business partners, and customers – reap the full benefits of your years of hard work.

Starting a business is easy. But running a successful one without compromising your personal life and finances takes time, effort, commitment, and a willingness to learn and improve your balance continually.

Resources

5 Ways to Separate Your Personal and Business Finances, SBA

Entrepreneurship and the U.S. Economy, U.S. Bureau of Labor Statistics

What Percentage of Small Businesses Fail? (And Other Need-to-Know Stats)

The Megaphone of Main Street: Startups, Fall 2019, SCORE

The 5 Worst Cash-Flow Mistakes Small-Business Owners Make, Entrepreneur

Access to Capital for Entrepreneurs: Removing Barriers

Statistics of U.S. Businesses (SUSB), U.S. Census

-------------

Heidi Clute, CFP® of Clute Wealth Management in South Burlington, VT and Plattsburgh, NY, an independent firm that provides strategic financial and investment planning for individuals and small businesses in the Champlain Valley region of New York and Vermont. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.