You take comfort in knowing your financial plan is designed to help you advance steadily toward your long-term goals — and to flex as your situation and goals change. But during 2020 and 2021, everything changed. So, let’s look at how to decide whether now is the right time for you to make a major financial move.

The Economic Impact of the Covid-19 Pandemic

After the 2020 year of pandemic lockdown and uncertainty that limited discretionary spending, many Americans were fortunate to feel a new sense of financial security in 2021.

- In February 2021, U.S. households had $2.4 trillion in savings, which was $1 trillion more than a year earlier.

- Pew Research Center reported that by March 2021, 53% of U.S. adults rated their financial situation as excellent or good.

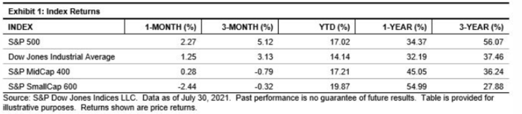

- Year-to-date equity market returns through July 2021 for the major indices exceeded 15

Combining a sense of financial confidence with a growing investment portfolio is a recipe for creating what look to be appealing new opportunities. But then add in a dash of news and social media, and you may begin to feel as if your carefully crafted financial plan is bland and limiting.

A Surge of Financial Questions Arise

So, it’s not surprising that requests for new or reworked financial plans surged nationally in 2021. We are honored when clients seek our help as CFP® professionals to work through economic changes and new opportunities. Here are the top questions we’ve been hearing:

- Is now a good time to buy a house — or a second home?

- Should I retire earlier than planned?

- Should I expand or turn over my business?

We believe each person has a unique best course to future financial wellbeing, and each category of major financial moves calls for specialized analysis. Yet, we find that pausing to assess where you are now and asking whether biases distort your reasoning are smart first steps for everyone.

How to Approach a Major Financial Decision: A Checklist

- Make the time to update or create a financial snapshot of where you are today. You need to know where you’re starting before you can chart or change your course. For example, ask yourself if your emergency fund should be increased before making a large cash outlay. Or perhaps helping a family member whose financial situation deteriorated during the pandemic is a higher priority for you. Your objective is to confirm your available resources — and then consider their best use to meet your life goals.

- Consider how one or more unconscious biases may have distorted your thinking. People are incapable of recognizing their own biases, which makes working with your financial professional or an independent collaborator most helpful in this step. However, the fact that individuals are not aware of their own biases does not mean that biases can’t be neutralized — or at least reduced — at a collaborative team level. Consider whether, for example, present bias, the availability heuristic, anchoring, or confirmation bias may have affected your desire to act now on a major financial move.

- Look at the financial implications of the specific financial decision you want to make. The larger the decision, the more comprehensive your analysis needs to be. Explore scenarios for the best case, worst case, and most likely given current conditions.

- Identify the pros and cons of your decision. For example, if you’re considering buying a second home in the current real estate market, a pro might be locking in a low interest rate if financing the purchase. A con could be potentially higher prices due to the “hot” market right now.

Tips for Making Specific Financial Decisions

Every major financial move deserves careful evaluation. Here are guidelines and tips for evaluating the top questions we’ve been hearing.

Is now a good time to buy a house — or a second home?

Should I retire earlier than planned?

Should I expand or turn over my business?

Business Succession or Expansion

Looking Ahead

It’s natural to take comfort in knowing you have a solid financial plan designed to help you advance your lifetime goals — and at the same time, want the flexibility to act as your situation and goals change. You can achieve both objectives simultaneously by deciding carefully and with thoughtful intention whether now is the right time for you to make a significant financial move.

Resources

U.S. Bureau of Economic Analysis, Personal Income and Outlays, February 2021

S&P Dow Jones Indices, July 2021

The Atlantic, The Cognitive Biases Tricking Your Brain

Visual Capitalist, 50 Cognitive Biases in the Modern World (infographic)

------------------

Christina Ubl, CFP®, is co-owner of Clute Wealth Management in South Burlington, VT and Plattsburgh, NY, an independent firm that provides strategic financial and investment planning for individuals and small businesses in the Champlain Valley region of New York and Vermont. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.