4 min read

Looking Beyond Your Student Loans: What Young Professionals Need to Know

Adam Robert : August 13, 2020

Imagine you have been out in the work world for nearly a decade and are doing well in your career. As your salary increased, you prioritized reducing your student debt by increasing your student loan payments each year. Suddenly, you realize your short-term future includes what once seemed nearly impossible — in a year or so your student loans will be paid off! Uh-oh, new financial decisions to be made. Let’s explore your financial future beyond paying off student debt and how to evaluate and choose the best options for you and your family.

Your Financial Future

Pause for a moment to feel grateful and celebrate. You set a financial goal to reduce your debt and you have (almost) achieved your goal. You’ve worked hard, likely denied yourself certain short-term pleasures, and focused on the necessity of debt reduction. Now you can set new financial goals and consider shifting the balance between your necessities, wants, and desires to create the life you want to live.

Needs vs. Wants vs. Desires

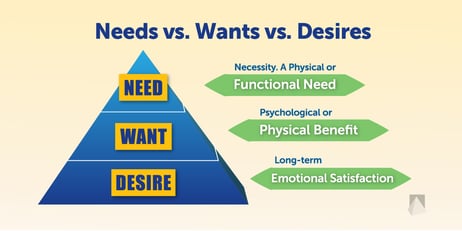

The classic economic definition of a need is something necessary to survive, a physiological necessity. This includes things like food, water, shelter, and often today, education and healthcare. In personal finance, it includes necessary financial payments because for example, if you do not pay your debts, you can be evicted from your home.

A want is one step up from needs and is something that you would like to have, either immediately or later. Your basic needs are limited while your wants are unlimited and may change over time. For example, you may already own a small home, but you want a larger one.

A desire is a lasting want that offers a strong emotional benefit. Wants may come and go but desires tend to linger. You may want a vacation each year but desire a trip around the world.

Definitions may change from person to person, and over time. Each of us must categorize needs and wants based on our financial resources and priorities. You need to have a mobile phone today, but you may want the latest, greatest iPhone. You need some form of transportation to get to work but it doesn’t need to be a new luxury car. Although rationally such decisions can seem easy to make, in practice consistently denying our wants can lead to a feeling of deprivation without the balance of a motivating goal. As the saying goes: “I want to live, not just survive.”

Fallacies and a Framework for Balancing Needs and Wants

Fallacy #1: There are absolute rules

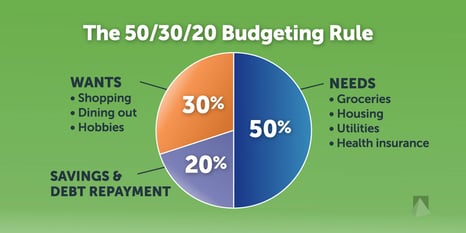

The 50/30/20 budgeting rule was popularized by the book "All Your Worth: The Ultimate Lifetime Money Plan." The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and 20% to savings and debt repayment. But before you can figure out if this approach is right for you, your current and long-term priorities, needs, and wants must be clear. This also may not be realistic for some; you may not be able to allocate as much to the wants category given your current income or a particular year of bad luck (think: expensive repairs).

Fallacy #2: It’s either this, or that

“Should I pay off debt or save for retirement?” is a question I hear regularly from clients. There’s often a chuckle (or a sigh) when I answer, “It depends.” That’s because multiple factors determine what is best for you, depending on your answers to questions like these:

- Does your employer offer a 401(k) match? If so, how much?

- What is the interest rate on the debt? What type of debt is it (student loan, mortgage, credit cards, etc.)?

- Do you have emergency savings set aside already?

It is likely you can use the money you have budgeted to both maximize the 401(k) match from your employer and pay down your debt. On the other hand, if you do not have a 401(k) match and your debt is in credit cards with a high interest, you may find the right balance by splitting your available dollars between using the snowball or avalanche method to reduce your debt while building up your emergency savings so you don’t have to use those credit cards again!.

A Framework for Balance

Consider a series of questions to help you think through your priorities when you are looking beyond your student loans to plan your financial future:

- Is my mid-term savings account adequate to cover my needs for an extended period?

- After my needs are met, what are my most important wants, my priorities?

- What are my wants and what do they look like as financial goals?

- Which wants will make me feel deprived if I do without now?

- Can I skip a few small wants now for a big desire longer term?

Developing a monthly budget becomes much easier when your priorities are clear. You may find that 50% on needs, 30% on wants, and 20% to savings works for you — or as your income grows and your basic needs remain the same, it may look more like 40/40/20 because you want something like a major home renovation in the near-term. If starting a business or early retirement are priorities, then 40/30/30 may be the right balance for you.

Looking to the Future

Making the time to think through your priorities to find the right balance of needs and wants is something you want to do annually. (If you missed it, see our popular article, “How to Have the Best Financial Date Night Ever!”) Enjoy the luxury of being able to think beyond your student loan repayments, set your new financial goals, and look forward to living the life you enjoy today while building for the future.

Resources

Financial Planning Tips for Your 30s and 40s, Christina Ubl

How to Have the Best Financial Date Night Ever!, Christina Ubl

50/30/20 Budget Calculator [NerdWallet]

Personal Income Spending Flowchart – United States

------------

Adam W. Robert, CFP® of Clute Wealth Management in South Burlington, VT and Plattsburgh, NY, an independent firm that provides strategic financial and investment planning for individuals and small businesses in the Champlain Valley region of New York and Vermont. This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.