5 min read

Do you Know Who's Managing the Family Money? You may be surprised.

Heidi Clute : April 20, 2023

For many families, this is a question getting new answers today because of changing family dynamics and the growing number of aging parents or family members. Long gone are the days when it could be assumed that managing family finances defaulted to “the man of the house.” At the same time, the Sandwich Generation is coming to terms with their aging parents and family members who need caregivers to help with many aspects of their lives, including managing their finances. Managing the family's investments is increasingly shifting to the one who is most likely to schedule the medical appointments, get the kids to school, and be the caregiver for aging parents: the working Mom.

Managing Family Finances Grows More Complex

The job is getting more complex. Today the majority of American families have stock market investments, either in an individual stock, a stock mutual fund, or in a self-directed 401(k) or IRA as well as college funds and recent or pending inheritances to consider. Plus, the introduction of personal financial apps and software makes it easier than ever for nearly anyone to start investing in the stock market. The rise in the number of adult children who have become caregivers for their aging parents adds a new level of complexity to “family” finances when the caregivers are expected to manage their parent’s finances, among other caregiving needs, alongside their own. The majority still try to handle this work without outside help, but we're seeing more people who are wondering if they're making the best choices with their family money and grappling with how to balance their own lives and finances, in addition to those they are caring for. Families are changing, and they're changing the way they do business.

A Common Challenge for Women

The biggest complaint I hear from women with financial planners or brokers is "He doesn't really know me." One woman told me, "My broker sort of came from my Dad with my inheritance. He reminds me of Dad's leather chair. Solid and comfortable, but I wonder if there's a better choice for me. I don't know how to evaluate that. What should I be looking for?"

This woman was in her high earning years with 18 years to go before she planned to retire. She had two children headed for college. Yet she was holding some quite conservative investments that had likely been appropriate for her father in his later years but not for her. She and her broker had not discussed her investment objectives or her tolerance for risk.

We were able to make significant changes for her.

Changing Gender Roles Over the Years

After (many) years of managing investments for women, men, couples, and families, I have never found one great formula that works for everyone! I don’t believe one-size-fits-all works for most important things in our lives especially financial planning.

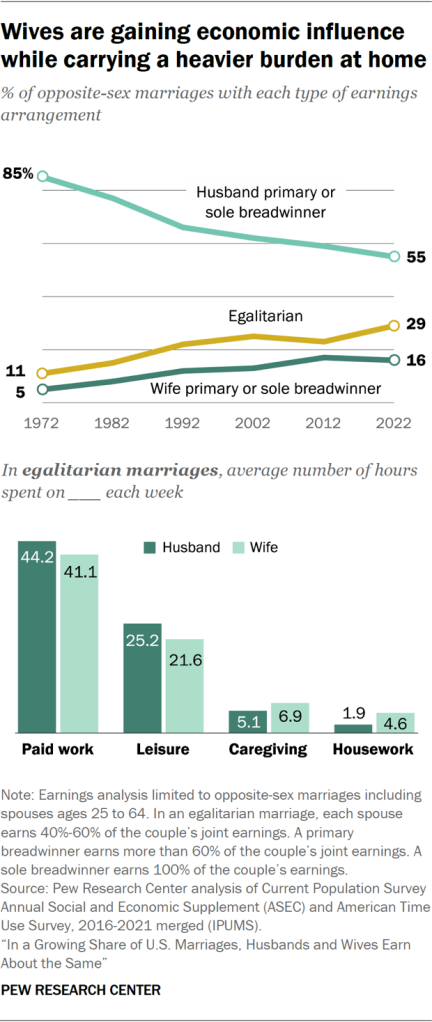

Among married couples in the U.S., the number of households where the woman earns more than their husband has tripled over the last 50 years according to studies done by Pew Research Center, but that is still just 16% of marriages. However, the number of households where the husband is the sole breadwinner has dropped 50% in the same timeframe, illustrating the shift that is becoming more and more common.

What isn’t reflected in the statistics about financial earnings is the burden of unpaid caregiving, for their own family as well as the growing population of adults who provide unpaid caregiving for aging parents and other family members. In the same study by Pew Research Center, it’s indicated that women in an opposite-sex marriage are still more likely to be doing a larger portion of the caregiving and housework, even if they are earning a higher income than their partners.

View the chart from the Pew Research Center and more data on their website.

The Value of a Second Opinion from a Team Player

It's not uncommon for clients to approach us with questions or ask for second opinions when they become caregivers for aging parents and must suddenly become the one who manages their parents’ finances and communicate with accountants, tax preparers, or other financial professionals that their parents were working with before. One client became the financial caregiver for their aging mother who lived in a different state. While there wasn’t any major concern, they approached us to ask for a second opinion and to give them confidence because they didn’t feel knowledgeable enough themselves to be able to evaluate the mother’s situation.

It's important that your financial advisor can understand the whole picture and take into consideration the factors that could be affecting your finances and financial decisions, like caregiving for another family member. A financial advisor can help you build a team of professionals to help when it feels like there are too many pieces to juggle on your own. Based on your situation, such a team might include:

- A financial advisor to manage your investments.

- An accountant to prepare tax returns.

- An attorney for creating and managing legal documents.

- An insurance agent or broker to protect your vehicles, homes, and income.

- A Daily Money Manager (DMM) to help with financial paperwork and bill paying for your or your parents’ household.

Five Questions We Recommend You Ask When Evaluating a Financial Advisor

- How is the financial advisor paid? Is the advice you receive based solely on your best interest (a fiduciary), or is it partly driven by commissions, sometimes called "revenue sharing?" People who provide service for a fee, such as a CERTIFIED FINANCIAL PLANNER™ Professional, are required to spell out how they are compensated and any potential conflicts of interest. People who sell securities such as stockbrokers have different requirements. Investments brokers recommend must be "suitable" for their clients, a standard seen as less stringent.

- What does this advisor know about you? Before making recommendations, has this person asked you about your life goals, your values, your family? When do you plan to need money for retirement, for college, a business expansion? How is your health?

- What are the advisor's experience and qualifications? What licenses or certifications does the advisor hold? What are the resources of his or her firm? I have been asked for a second opinion on a financial plan proposed by someone described only as a "financial planner." I learned that he was a full-time employee of an insurance company, was not a CFP® Professional, and was quite limited in the kinds of investments he could handle.

- Does he or she have other investors with assets, goals, and interests like yours?

- Where is the advisor licensed or registered to practice?

Just as it is with finding the right medical care and the right schools for your family, the careful choice of your professional financial advisor can make a lifelong difference in your family's financial security. The first step is to pick up your financial plan or last investment statement and get another opinion. Whoever is managing your family finances, we urge you to take the time it takes to get all the answers you need.

Resources:

Why a Family Meeting on Finances is a Good Idea (Clute Wealth Management)

What is a Daily Money Manager – Video (Clute Wealth Management Lakeside Chat)

American Association of Daily Money Managers

What Percentage of Americans Own Stock? (Gallup)

In a Growing Share of U.S. Marriages, Husbands and Wives Earn About the Same (Pew Research Center)

Heidi Clute, CFP® is co-owner of Clute Wealth Management in South Burlington, VT and Plattsburgh, NY, an independent firm that provides strategic financial and investment planning for individuals and small businesses in the Champlain Valley region of New York and Vermont.

Securities offered through LPL Financial. Member FINRA/SIPC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal. No strategy assures success or protects against loss.